On 15 July 2025, the European Commission released the European Innovation Scoreboard and the Regional Innovation Scoreboard for EU Member States but also covering Western Balkans.

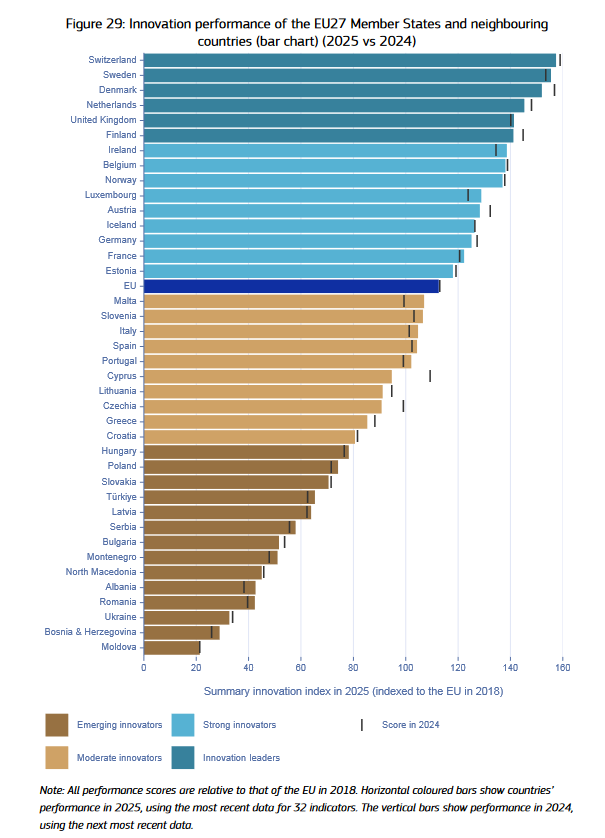

Similarly to previous editions, the European Innovation Scoreboard 2025 provides a cateogrisation in four innovation groups based on their scores: Innovation Leaders (performance is above 125% of the EU average), Strong Innovators (between 100% and 125% of the EU average), Moderate Innovators (between 70% and 100% of the EU average) and Emerging Innovators (below 70% of the EU average).

Several non-EU countries are also profiled in this system, among them also five Western Balkans. Their innovation performance continues to improve, following consistent upward trajectories since 2018. However, the region as a whole still lags behind the EU average, with all of them classified as Emerging Innovators.

- Albania. Emerging Innovator, performing at 37.9% of the EU average in 2025.

- Bosnia and Herzegovina. Emerging Innovator, performing at 25.7% of the EU average in 2025.

- Montenegro. Emerging Innovator, performing at 45.3% of the EU average in 2025.

- North Macedonia. Emerging Innovator, performing at 40.0% of the EU average in 2025.

- Serbia. Emerging Innovator, performing at 51.5% of the EU average in 2025.

The European Innovation Scoreboard interactive tool allows for customised comparisons of performance scores. It allows to visualise country profiles, compare relative strengths, weaknesses and trends, and test correlations between indicators: EIS interactive tool

Based on a revision process undertaken in late 2024 and early 2025, the EIS 2025 applies a revised indicator framework to the one used for 2021-2024.

For more information, such as the country profiles of the European Union Member States, the methodological reports and downloadable databases, please refer to the source page of this announcement: https://research-and-innovation.ec.europa.eu/statistics/performance-indicators/european-innovation-scoreboard_en#european-innovation-scoreboard-2025

The position of the Western Balkans

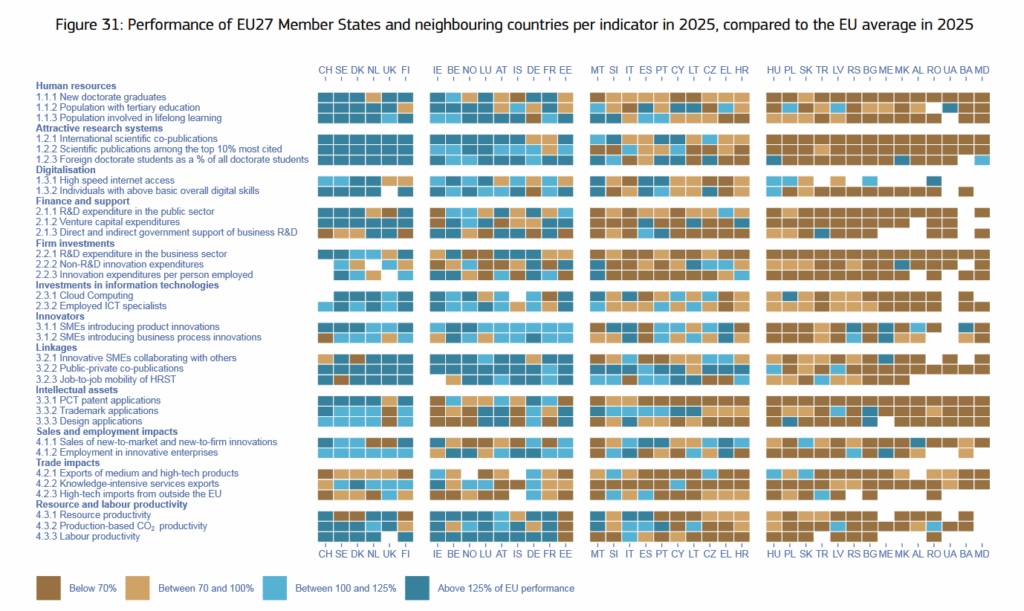

The EIS 2025 highlights also that each Western Balkan economy has its unique strengths and gaps as well as common momentum towards EIS priorities. The respective reports provide further data to be analysed.

For Serbia, the report highlights strong areas such as a high share of SMEs introducing product and business process innovations, as well as notable employment in innovative enterprises. Serbia saw significant growth in areas like cloud computing, ICT specialists, and collaboration among innovative SMEs between 2018 and 2025. However, the country continues to face challenges in high-tech imports, design applications, and labour productivity, all of which remain well below EU averages. Its resource productivity, production-based CO₂ productivity, and trademark applications are among the lowest ranked indicators. Despite improvements in international scientific co-publications and top-cited publications, challenges persist in skills development: while there have been increases in tertiary education attainment, lifelong learning and the number of new doctorate graduates have declined, and basic digital skills among individuals have decreased since 2018.

The strongest aspects of Montenegro‘s innovation system are the exceptionally high rate of SMEs introducing product innovations, robust performance in business process innovation by SMEs, and significant levels of employment in innovative enterprises. The country also demonstrates strength in collaboration among innovative SMEs. However, Montenegro’s relative weaknesses are clear in its very low levels of direct and indirect government support for business R&D, minimal venture capital expenditures, and an absence of design applications. Despite an increase in tertiary education attainment and some progress in scientific co-publications, Montenegro ranks low in new doctorate graduates, lifelong learning participation, and digital skills among individuals. Investments in R&D and venture capital have grown only slightly, and overall business investment in R&D remains stagnant.

North Macedonia‘s innovation system demonstrates relative strengths in the share of foreign doctorate students, non-R&D innovation expenditures, and exports of medium and high-tech products. In contrast, persistent weaknesses are observed in government support for business R&D, design applications, and venture capital expenditures, with low public sector R&D spending. North Macedonia’s innovation activity is mainly driven by non-R&D-related investments, standing well above the EU average, though this is largely derived from limited data and should be interpreted with caution. Human capital metrics show both progress and challenges, as the country improved in tertiary education attainment and international scientific collaboration but remains low in lifelong learning and digital skills. Although there has been a significant growth in information technology investment and employment of ICT specialists, overall digitalisation levels are still well below EU standards

Albania shows notable strengths in the sales of new-to-market and new-to-firm innovations, the share of SMEs introducing product innovations, and production-based CO₂ productivity. Structural improvements since 2018 include significant growth in tertiary education attainment, new doctorate graduates, and lifelong learning participation, though each remains well below EU averages. The innovation ecosystem is primarily driven by dynamic SMEs, as seen in rising product and process innovation rates; however, digital skills and public/private sector R&D spending are limited, and the connection to international research networks remains weak.

Bosnia and Herzegovina’s innovation strengths include a remarkably high proportion of SMEs introducing product innovations, notable rates of business process innovation among SMEs, and above-average employment in innovative enterprises. Nonetheless, the nation’s innovation ecosystem is significantly hampered by persistent weaknesses: R&D expenditure in the public sector is reported as zero, there is virtually no venture capital activity, and direct or indirect government support for business R&D is absent. Investments in innovation per employee are low, and overall digitalisation remains limited. In recent years, there have been some positive developments, such as a rise in cloud computing usage and employment of ICT specialists, but long-term deficits in tertiary education, lifelong learning, and internationally cited scientific publication rates persist.

Source: European Innovation Scoreboard 2025. https://research-and-innovation.ec.europa.eu/document/download/3d4f12c2-033e-451b-9c4c-0d28c0339cfe_en?filename=ec_rtd_eis-2025-main-report.pdf, page 76. Accessed 15 July 2025.