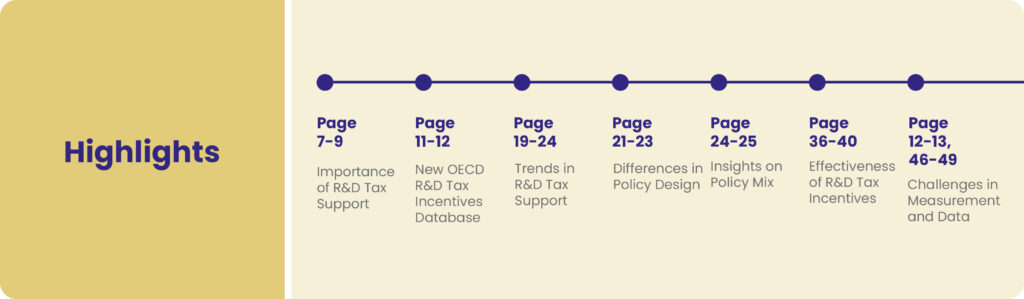

Besides direct support measures such as grants, governments worldwide increasingly rely on tax incentives to promote business R&D and encourage innovation and economic growth. Since 2007, the OECD has been developing measurement and data infrastructures to provide qualitative and statistical evidence on the use, cost and impacts of R&D tax incentives. This new and interactive OECD tool aims to provide a single point of access to resources in this area and facilitate policy analysis and comparison of national schemes based on their design features, drawing on the contributions of OECD countries and partner economies to the annual R&D tax incentives survey.

Thematic domains:

Details:

Format:

Author(s):

Silvia Appelt, Fernando Galindo-Rueda, Ana Cinta González

Language:

English

Year:

2019

Length:

70 pages

Geographical focus: